It’s not exactly surprising that with all of the uncertainty in the world, Apple decided that it couldn’t provide useful revenue guidance for its fiscal Q3 ending in June. It is unexpected, however, that Apple felt confident in announcing a silver lining to the pandemic —it expects to sell more Macs and iPads in the summer of 2020 compared to 2018.

iPad Pro and Magic Keyboard make for a compelling mobile computing solution

Analysts and journalists initially speculated that Apple would not be able to restart manufacturing or even launch new products within the March quarter, during which the coronavirus pandemic erupted, resulting in closed factories and retail stores. Those fears didn’t materialize as predicted because of Apple’s broad and deep operational expertise and the clear participation of China, which desperately needed Apple to return to normal as rapidly as possible for its own economic sake.

Recall that just a few weeks earlier, various pundits were even musing that China might “turn on Apple” over the country’s contention with tariffs imposed by America, or that the state was drumming up patriotic propaganda promoting domestic brands including Huawei while vilifying iPhones. As it turned out, none of those things were real. China desperately needs Apple, both to drive continued employment and economic growth and to help its domestic device makers know how to design their own phones and AirPod lookalikes.

Apple’s global supply chain with its significant reliance on assembly in China has proven far more resilient than virtually anyone had expected, and certainly more than the Wall Street Journal and other sites, who initially claimed that Apple’s position in China was both a grave mistake and a tremendous weakness. Apple’s ability to rapidly recover its manufacturing capacity and adapt to a world with shuttered retail locations helped the company report record earnings in the March quarter.

A mixed bag of summer expectations

However, going forward, how will Apple perform as the global economy begins to feel the full effects of mass unemployment and corporate belt tightening? Similar predictions of doom have claimed that Apple’s sales will fall off a cliff during the current quarter as the financial impact of COVID-19 continues to grow. However, while Apple didn’t offer its typical revenue guidance for the June quarter, its chief financial officer Luca Maestri stated the expectation that its sales would be mixed, not merely down across the board.

“On iPhone and Wearables, we expect a year-over-year revenue performance to worsen in the June quarter relative to the March quarter,” Maestri stated during Apple’s earnings call, adding that “on iPad and Mac, we expect the year-over-year revenue performance to improve in the June quarter.”

The idea that Apple’s computers and tablets are expected to turn in better results this summer than Apple experienced last year is remarkable. Clearly, the stories invented by pundits do not benefit from the same sort of insight available to Apple’s executives.

Remote work and distance learning to drive new Apple sales

While Apple expects its massive installed base of users—which actually continued to grow in size during the March quarter—to delay some purchases for high-value items such as iPhones, the restrictions imposed by the pandemic are actually boosting the demand for computing devices that facilitate remote learning and working from home. Apple even detailed very large purchases of iPads made by various schools.

“We are in the process of deploying major orders of iPads to school systems working to keep learning going strong at a distance,” Apple’s executive Tim Cook stated, “including tens of thousands in Ontario, Canada; Glasgow, Scotland and Puerto Rico, a 100,000 to the city of Los Angeles and 350,000 to New York City, our largest educational iPad deployment ever.”

It’s almost as if Apple didn’t actually lose its entire education business to low priced Chromebooks from Google’s partners, as Bloomberg worked to assert between 2014 and 2018.

For every year of its existence, iPad has attracted intense criticism. I was there at the initial launch of iPad in 2010, where Steve Jobs released a vision for a computing tool that designed to be both better than a smartphone and superior to PCs for specific tasks.

I witnessed firsthand how the media overwhelmingly dumped on iPad, puzzled at why it wasn’t more like a Mac. Every year since, we’ve seen demands from pundits insisting to know when Apple would bring back Flash, overlapping windows, and of course a mouse.

Even after iPad was solidly being recognized by every corner of the industry—from Android bloggers and Google to even IDC and Gartner—as being the only really viable and commercially successful tablet that consumers have ever wanted, Apple still gets reams of condescending think pieces attempting to perform an autopsy on iPad and explain what exactly the company did wrong to create such a disastrously flawed product.

Finding opportunity in a pandemic crisis

One of the most important things iPad has achieved over the past decade, beyond rapidly expanding the installed base of users on Apple’s computing and development platforms, was to finance the development of Apple’s A-series custom silicon engines. iPad has uniquely driven a viable market for what Microsoft once called “ultra mobile personal computing,” and over the last decade that demand for high power, high-efficiency silicon has given Apple the revenues and scale to effectively become its own Intel.

It now appears that within the next year, Apple will begin releasing new computers powered entirely by its own custom silicon. Today’s Macs already feature key technologies adapted from iPad in the form of the T2 chip, which provides security, hardware-accelerated video encoding and encryption, and enables new hardware features ranging from Touch ID to Touch Bar to Sidecar.

This year’s big drive to support working at home and remote learning could turn the COVID-19 pandemic around from a pure crisis into a new opportunity for Apple to sell through its final generations of x86 Macs. Apple is also likely to use the nadir in economic activity to encourage developers to take full advantage of new tools that both bring existing iOS software to the Mac with Catalyst, and perfect the process of making the App Store a seamless way to distribute the appropriate code optimized for whatever specific hardware a user owns, regardless of who designed the silicon.

At WWDC19, Apple showed its first-year efforts to bring UIKit iOS apps to the Mac via Project Catalyst

So far, this has focused on “thinning,” or efficiently downloading only the code and resources a specific device needs. But the same mechanism can allow Apple to seamlessly support app downloads to future Macs or iOS notebooks powered by Apple’s custom silicon rather than an Intel x86 chip. This kind of infrastructure has never quite existed before, making it far more difficult for users to find software that runs on their hardware. This was once a showstopper for Microsoft’s plans for Windows NT across various chip architectures in the 1990s, complicated the sale of WinCE handhelds in the 2000s, and then ARM-based Windows RT devices in the 2010s.

Apple’s extensive work and investment in compiler technology and its efforts to build development frameworks suited to the needs of millions of developers ranging from indie coders to enterprise app teams have given the company the same kind of flexibility in designing silicon and hardware that its operational supply chains have given it to produce new products in mass volumes at low cost.

So while the world’s pundits imagine that Apple is running out of steam with iPhone sales, the reality is that Apple is perfectly positioned in the 2020s to develop the kind of highly mobile and even wearable new computing devices and form factors of the future, and to deliver the code developers write to make these devices more powerful, without any dependence on another chip maker to design its silicon. In contrast, Microsoft and Google failed to sell their own smartphones and tablets year after year when that’s what people were buying.

Trying to pull off such an ambitious transition might actually be harder if there were not a pandemic keeping people stuck at home and hungry for new ways to support themselves. Apple has consistently pushed programming as something every student should learn. Its latest efforts with Swift, Playgrounds, and related development tools is coming in fruition just as a generation of young people are entering an economy ravaged by the pandemic, and where lots of people from a wide variety of professions are suddenly finding that there may not be any immediate change in their circumstances unless they find new ways to adapt.

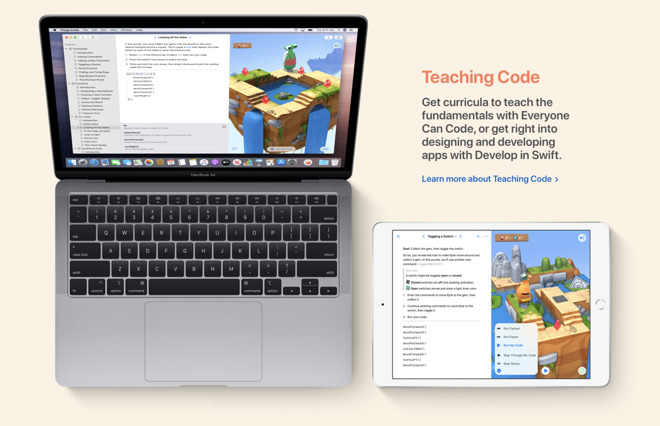

Teaching software development has been a key investment at Apple

By making tools and products that can help anyone transition to a new career in software development, Apple is again positioned to turn COVID-19 from a disaster into an opportunity for many people affected by shutdowns and limited mobility. And as Apple expects, those people will be investing in Apple hardware to take advantage of that opportunity.

The worst news for the June quarter

Apple certainly won’t be unscathed by the collapse of industries and companies around it, and this is practically demonstrated by the company not issuing guidance for its third fiscal quarter of 2020. While some economic turmoil will give the company the ability to snatch up acquisitions and teams of talent that it might not otherwise be able to do, Apple’s pace of sales to consumers who lose their jobs or face a reduction in business will be substantially lower.

Yet, Apple’s expectation of lower than usual sales of its high-end iPhone and Apple Watch models during the June quarter appears to be far less traumatic for Apple than the fallout of Android makers who were expecting to ship massive volumes of low-end products to emerging markets and to the value segment of buyers who were already struggling to pay $250 for a new phone.

Again, the dark clouds of the pandemic offer a silver lining to Apple in both its premium phones and wearables including Apple Watch and AirPods. Users who are stuck at home are even more exposed to their digital devices as their primary link to the outside world. There isn’t anything else that more people willingly spend more money on as a personal luxury than their smartphone. Apple’s installed base of users was clearly already less preoccupied with pricing because they were willingly paying $999 or more for new iPhones in a world where pundits liked to point out that Androids could be had for much less.

Yet just as Apple’s customers face their first real test of “what do they buy when the economy tanks?” Apple is offering one of its best entry-level value offerings with iPhone SE. This product can not only blunt any interest in defections to Android, but is already attracting the interest of Android users, again turning the pandemic crisis into an opportunity for Apple.

Watch for health

The increased interest in health sparked by the pandemic is also creating new awareness of the value of Apple Watch. Maestri noted that “our wearables business is now the size of a Fortune 140 company, and we’re very excited by the many opportunities in front of us for this product category. For example, Apple Watch continues to extend its reach, and over 75 percent of the customers purchasing Apple Watch around the world during the quarter were new to the product.”

This year, Apple may finally be able to release blood oxygen monitoring as a feature of Apple Watch; so far, this appears to have been held up by FDA approval. That could be important because one of the ways to identify a COVID-19 infection is the low blood oxygen caused by its effect on lung health. Unlike other conditions that attack the lungs, many of those infected do not feel sick or out of breath until the disease has caused significant lung damage, suggesting that early detection could help improve recovery efforts and help stop the spread of the disease by carriers who don’t yet feel ill.

Even without peak sales of iPhones and Apple Watch in the June quarter, strong sales of Macs, iPad, and the ongoing strength of Services could help set Apple up for a better recovery this fall than might otherwise be expected in the current circumstances. That’s because users are more likely to delay purchases rather than take their business somewhere else.

There is no indication that any other phone or device maker is better situated than Apple. In fact, as we predicted back in February, the hopes of Android makers this year were grounded on 5G connectivity and the allure of expensive folding displays or nostalgic form factors, none of which are looking very exciting right now as the impacts of the pandemic become more clear.