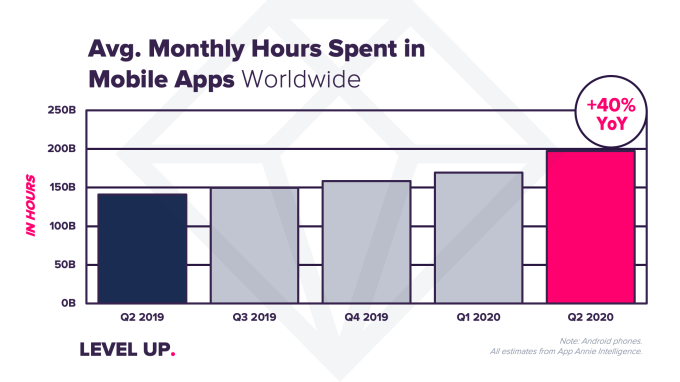

As the world continued to cope with the impact of the coronavirus outbreak, the second quarter of 2020 became the largest yet for mobile app downloads, usage and consumer spending. According to new data from app store intelligence firm App Annie, mobile app usage grew 40% year-over-year in the second quarter of 2020, even hitting an all-time high of over 200 billion hours during April. Consumer spending in apps, meanwhile, hit a record high of $27 billion in the second quarter. And app downloads reached a high of nearly 35 billion.

The growth in app usage has been fueled by social distancing and lockdown measures, as countries around the world try to quell the spread of the novel coronavirus.

Image Credits: App Annie

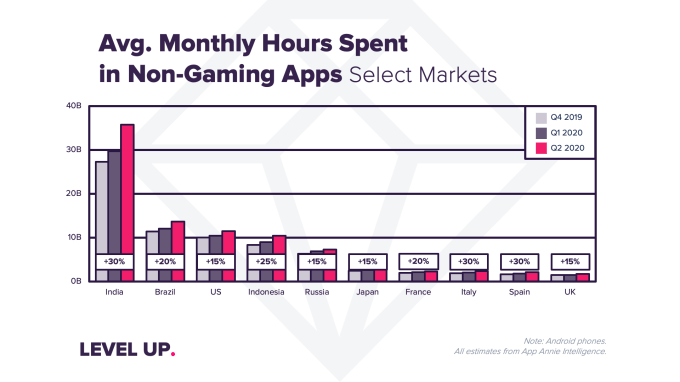

In India, for example, time spent in apps grew 35% in Q2 2020 from Q4 2019. Italy and Indonesia saw growth of 30% and 25%, respectively. In the U.S., time spent in apps grew 15%.

App Annie says now the average user is spending 4 hours and 20 minutes per day on their smartphones.

Image Credits: App Annie

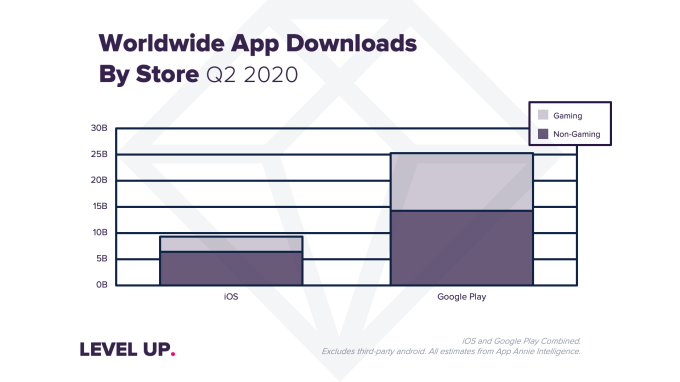

But consumers aren’t just launching apps they already have installed on their phones — they’re also downloading new ones. In the second quarter, consumers downloaded nearly 35 billion new apps, an all-time high.

Google Play accounted for 25 billion of those downloads, representing 10% year-over-year growth. India and Brazil were the the two largest markets for Google Play in the quarter.

Image Credits: App Annie

iOS downloads grew 20% year-over-year to reach nearly 10 billion. The U.S. and China were iOS’s biggest markets for downloads, but the U.S. and Saudi Arabia saw the most quarter-over-quarter growth. The latter was likely attributed to a nationwide lockdown and school closures, driving app downloads in the country to a all-time high in April and 100% year-over-year growth on iOS.

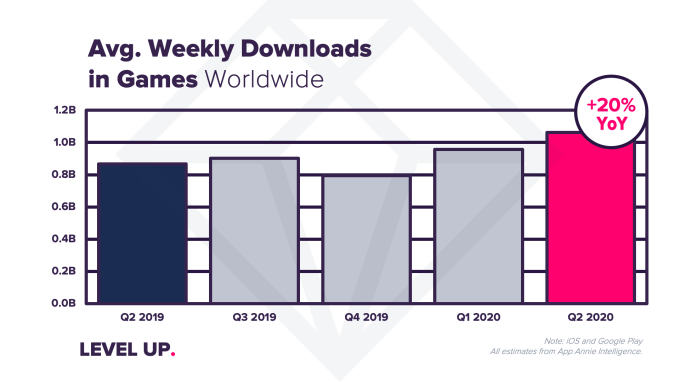

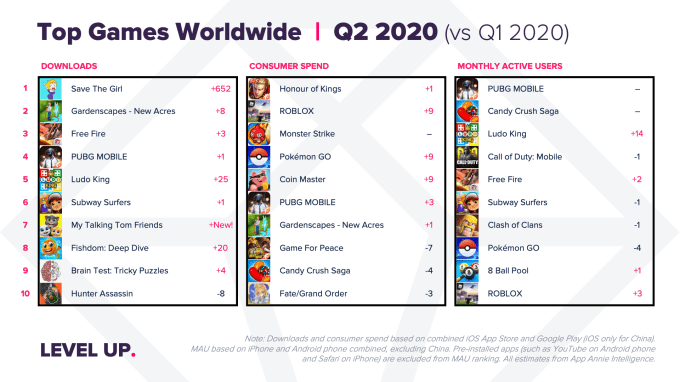

Games were downloaded at record levels in the quarter, App Annie noted, totaling 14 billion games. In the first week of Q2, weekly mobile game downloads broke records at over 1.2 billion, and weekly download levels remained at 1 billion on average throughout the quarter, up 20% year-over-year.

Image Credits: App Annie

Non-gaming apps represented over half (55%) of the new downloads on Android and 70% of those on iOS.

More specifically, top categories outside of games included “Tools” and “Entertainment” on Google Play and “Photo and Video” and “Entertainment” on iOS. But other categories saw strong growth, including “Business,” “Health & Fitness” and “Education,” which saw quarter-over-quarter growth in downloads of 115%, 75% and 50% respectively on Google Play.

On iOS, “Health and Fitness,” “Shopping” and “Medical” apps saw strong quarter-over-quarter growth of 30%, 25% and 20%, meanwhile.

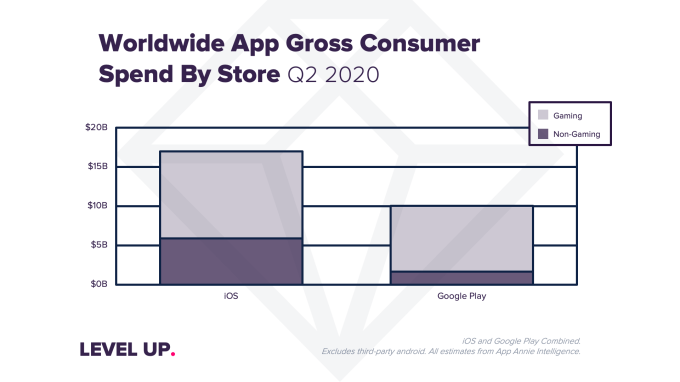

With record downloads and usage, consumer spending also grew significantly as a result, particularly among streaming video services.

Image Credits: App Annie

In the second quarter, consumers spent a record $27 billion in apps, up 15% year-over-year to $17 billion on iOS and up 25% to $10 billion on Android.

Games accounted for $19 billion of the spend, up 15% quarter-over-quarter. Google Play saw sizable growth at 25% quarter-over-quarter, which was 2x the growth rate on iOS.

Image Credits: App Annie

Non-gaming apps were 35% of the spend on iOS. The U.S. and China the largest contributors in both games and non-game apps on iOS in the quarter. However, the U.S. notably took back the top position as the largest market for consumer games — a spot previously held by China — with 30% quarter-over-quarter growth in Q2.

Non-games were 15% of the spend on Google Play. The U.S., Japan, and South Korea were the largest markets in both non-games and games alike on Google Play.

Top Google Play categories in addition to “Games” included “Social” and “Entertainment.” Growth in the “Entertainment” category was driven largely by Disney+ and Twitch, App Annie noted.

On iOS, “Entertainment” and “Photo and Video” were the largest categories by consumer spend, in addition to “Games.” Here, TikTok drove growth for the “Photo and Video” category, becoming the No. 1 top-grossing app on iOS App Store globally in Q2 2020 thanks to sales of virtual gifts used to tip streamers.

Image Credits: App Annie

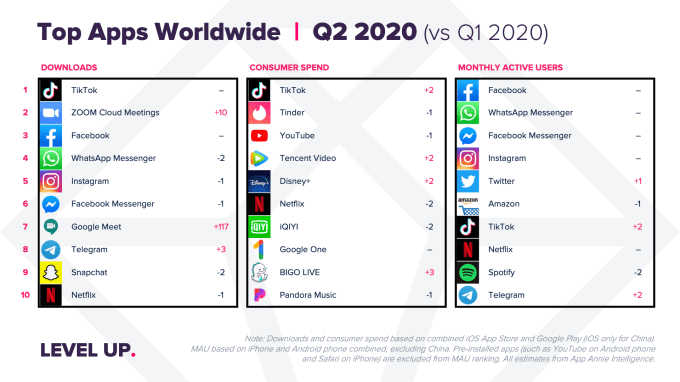

While much of the activity taking place on mobile devices during the pandemic is related to having fun — like watching videos or playing games, for example — several of the top apps in the quarter were work-related.

Zoom, for instance, became the No. 2 of most downloaded app globally in Q2 2020. Google Meet was No. 7.

TikTok, meanwhile, was the top app by downloads and spending, and the No. 7 by monthly active users. That will likely change in the months ahead, due to its ban in India. A proposed U.S. ban has also recently seen TikTok rivals gaining ground. Amid this disruption, local competitors in India have seen increased usage, and elsewhere, competitors like Byte and Likee have surged.