Two major financial papers that usually blow out false news about Apple’s supply chain in lockstep have suddenly diverged in their imagined tales of how the world’s best capitalized and most proficient and competent tech company might be somewhat challenged by the economic disaster now killing thousands of people.

Apple Park isn’t exactly needing a GoFundMe

Never mind the devastation, worry about a trillion-dollar corporation that has proven itself to be nearly impervious to disasters of all sorts. That’s the message from Japan’s Nikkei Asian Review and the Wall Street Journal, although right now each is pursuing the narrative in independent directions.

Doom pundits worry about the richest entity in tech

Don’t worry about pandemic deaths and the conspicuous lack of action that is exacerbating what appears to be the world’s worst crisis since World War II. No, worry about how Apple is going to survive 2020 with its hundred billion dollars of capital waiting to snap up deals in the coming fire sales of despair among companies actually at risk.

Both Nikkei and the Wall Street Journal have a bizarre fascination with predicting some potential of doom for Apple that just never seems to materialize.

In part, that’s because Apple has incredible power and money. It’s perhaps the only global enterprise to simultaneously be the tariff-exempted darling of the United States and a “too big to fail” essential investment partner of the People’s Republic of China. If straddling the world’s two superpowers wasn’t enough, Apple is also carrying so much cash that its investors have been concerned that it is simply too rich to be able to effectively invest its money rapidly enough.

Of all the trillion-dollar corporations—or even Fortune 500 companies—one could worry about, Apple is perhaps the most absurd to be shedding any tears over. Just over the past three months, Apple has danced around World War III and made a laughingstock of analysts like Toni Sacconaghi who have been claiming for years that Apple’s “best days were behind it.”

CNBC touted Toni Sacconaghi as a top Apple analyst despite being dramatically wrong

Then, at the height of panic and isolation under the unfolding pandemic of the new Coronavirus, Apple floated out new updates that bring LiDAR 3D scanning and advanced AR to its new iPad Pro and rolled out much faster MacBook Airs, along with new Apple Arcade games and new TV+ series, as if its a Merry Christmas rather than a dreary crisis.

Not merely tone-deaf to the situation, Apple has also used its platforms to offer reassuring, reliable information about COVID-19 from its App Stores, Apple News, and even its Apple TV+ collaborations with a motherly Oprah Winfrey to help us all cope with the uncertainty. The company also just made available a COVID-19 symptom screening website and app based on the recommendations of the CDC.

Yet despite all the upheaval caused by the COVID-19 pandemic, headlines still need to be made and stock prices still need to be manipulated by well-timed news drops from sources that are consistently wrong in their predictions about the absolute worst-case scenario that could possibly beset Apple.

Nikkei don’t lose that number

The reframing of the coronavirus pandemic as a reason to worry about Apple’s financial situation—perhaps the best-positioned entity on earth in terms of clout and capital—was kick-started by Japan’s Nikkei earlier this week in an absurd piece that speculated that the company’s upcoming iPhone 12 could potentially be delayed by “months,” based on nothing more than the same anonymously-sourced predictions the Nikkei has launched at iPhone virtually every year over the last seven, regularly claiming that Apple’s latest iPhone release was running into worrisome troubles that never subsequently materialized.

The story comes just several weeks after the Nikkei earlier claimed in February that “public health experts” in China had determined a “high risk of coronavirus infection” at Foxconn facilities where Apple assembles its products. That earlier report was immediately refuted by local authorities in Shenzhen. Officials stated in social media channels that the report was untrue. It also noted that inspections were still ongoing but that factories were expected to resume production “in a timely matter,” and that none of the factory operators have requested any “need to resume production earlier (than the local governments’ recommendations).”

Those factories have since reopened without any reports of “coronavirus infection” being a problem. The Nikkei didn’t retract its false report, it simply moved on to float out new ones.

Authorities refuted Nikkei’s farcical claims that Foxconn factories were a “high risk of coronavirus infection”

The latest Nikkei bombshell aiming at Apple’s iPhone 12 launch date similarly contradicted known facts from reputable sources, including comments from Foxconn. Immediately after it was published, the idea was also refuted by Loup Ventures’ analyst Gene Munster, who pointed out that Apple’s iPhone launches are not simply thrown together in the space of year, but involve three or four years of advanced planning.

“By the end of March in a given year, the vast majority of work on an iPhone design and planning with the supply chain is already done,” Munster wrote. “In the midst of 5G iPhone delay rumors, it’s important to keep in mind that Apple plans its business in terms of decades, not years – an under-appreciated long-term competitive advantage. At the core of this advantage is the company’s balance sheet, which allows it to survive the unexpected; everything from COVID-19, to a financial crisis, or weak initial demand for a new iPhone.”

Component producers also pushed back on the Nikkei story, stating that Apple had not asked them to postpone production and that they had received no request nor any notification about production being delayed. If anything, component producers are bracing for limited demand in the aftermath of COVID-19 interruptions.

Those interruptions have already hit Apple’s Android competitors harder than they have iPhone sales, as we predicted they would. That’s in part due to Apple’s resilient global operations, which can better adapt to crisis and prioritize development and production simply by way of Apple’s profitability and capitalization.

This all happened before

For years, Nikkei has been outlandishly claiming, without any verifiable basis, that Apple had “slashed production” of its latest iPhone. That’s been routine since at least 2013, the year that Apple’s chief executive Tim Cook first took the time to state in an earnings call with analysts that, “I don’t want to comment on any particular rumor, because I would spend my life doing that, but I would suggest it’s good to question the accuracy of any kind of rumor about build plans.”

As if a clown car wrapped around a tree

Ever since, a variety of analysts and investors have consistently ignored Cook’s advice to instead entertain every rumor Nikkei has floated out, despite year after year proving that the financial newspaper was again wrong, and that what Cook had stated was correct—Apple’s supply chain movements are simply so complex that no outsider has been able to accurately chart out what was happening in advance—even in broad strokes.

Yet the Nikkei hasn’t stopped generating its fake news built on supply chain rumors. In 2015 it claimed Apple had cut supplier orders for iPhone 6s models by an unbelievable “30 percent,” then returned the next year with the story that Apple planned to cut its iPhone 7 orders in 2016 due to “sluggish sales,” then flat-out insisted a year later that Apple was slashing production orders “in half” for iPhone X due to “slower than expected holiday sales” the U.S., China, and Europe. It’s as if they were trying to see how dramatically they can lie without breaking down in laughter.

The Nikkei wasn’t just throwing out gag figures and letting its audience piece together a false impression of what was happening. Instead, it actually reported in early 2018 that iPhone X “has failed to catch on globally,” and then, in a sort of desperate attempt to boldly state the most preposterous horseshit possible, announced that “iPhone X features facial recognition and wireless charging, but unlike previous models, is widely regarded as lacking any groundbreaking new technology.”

Groundbreaking manure

From the time Apple debuted iPhone X at the Steve Jobs Theater in late 2017 right up to the point where even Bloomberg was forced to admit that the new device had absolutely crushed all notion of expectations on how well a $999 luxury-priced smartphone could possibly sell, nobody with any grasp of reality could ever claim with a straight face that iPhone X “lacked groundbreaking technology.”

iPhone X absolutely destroyed Bloomberg’s narrative

Yet the Nikkei did anyway, erasing any question of whether the company has any interest in reporting accurately when there is the potential to scribble up absolute lies about what is happening in the consumer tech industry just to promote outrage, controversy, and social networking engagement. And, perhaps, foment market panic.

It would similarly be a lie to suggest that Google’s Pixel 4 or Samsung’s Galaxy S10 “lacked groundbreaking technology,” because every major phone maker really has no problem delivering solid advances every year, thanks to the constant progress of silicon, software, and advanced product development. Introducing “groundbreaking technology” in a smartphone over the space of a year is actually not all that hard; the real challenge is introducing advanced tech at an affordable price that can sustain a critical mass of sales required to generate operational profits and successfully fund future research and development.

Google has been historically forced to massively subsidize its money-losing Pixel efforts with its advertising revenue. Samsung’s high-end phone advancements are effectively paid for from sales of its far more profitable advanced components and displays. Even firms like Andy Rubin’s Essential were able to create “groundbreaking technology,” they just weren’t able to effectively sell it and stay afloat.

The willingness of the Nikkei to report such a boldfaced, confident expression of counterfactual nonsense should have erased its credibility completely. This wasn’t a typo or even an incredible mistake on the order of the Wall Street Journal falsely reporting that China’s Xiaomi was was ten times as profitable as it actually was back in 2013. This was a flat out representation of false information, coaching along a fictional narrative that was ultimately proven without any doubt to be dead wrong.

Nikkei isn’t just wrong when it’s bashing Apple. Late last year, the paper claimed Apple had increased orders for iPhone 11 “up to 10%, or 8 million units,” while also hedging its bets with the comment that “suppliers remain cautious and said they were concerned that the higher level of orders would not be sustained.”

Those numbers didn’t predict anything, and there is no verifiable basis for believing that suppliers were “cautious” about iPhone 11, which turned out to again be wildly successful, reversing the expectations that investors had developed about Apple’s future potential.

Yet for some reason, when the Nikkei popped this week to claim that iPhone 12 might miss its due date by “months” —a nutty idea that would seemingly require Apple to launch its new iPhone in the spring and miss the holiday season entirely —skittish investors again scrambled as if they couldn’t not be fooled by a paper that has been consistently wrong in its reporting of consumer demand and unit production of iPhones since at least 2013.

Tripp Mickle: hold my beer

Next to the Nikkei, only Bloomberg, the New York Times, Reuters, Yahoo, CNBC, the Wall Street Journal and perhaps a few other major financial news sources have similarly generated consistently false reports about the future prospects of Apple’s next iPhone.

Generally, Tripp Mickle of the Wall Street Journal has simply repeated the Nikkei angle on Apple, embellishing the narrative with even more absurd figures that are just as unreliable and nonsensical, like a literal game of Telephone.

This week, however, Mickle took the unique tack of postulating that Apple’s supply chain production isn’t going to be its biggest problem. Instead, he mused, economic fallout from the devastating pandemic will cause Apple’s installed base of around one billion customers to balk at buying a new iPhone this year. As proof, Mickle found an anecdote in a 42-year old sports-radio producer who has been laid off, making it difficult to justify his normal purchase of “four new iPhones every two years” for his family.

Of course, Apple never sells every one of its iPhone users a new iPhone each year. The company’s current sales have hovered about a quarter billion new iPhones each year, meaning that on average only about a quarter of its customers buy a new iPhone in any given year. Mickle’s anecdotal, financially strapped individual has the next two years to catch up to his historical pace of iPhone buying, making it seem particularly strange that Mickle even cited the man as proof of anything.

You’re so two thousand and late

The media narrative of the last year has been that Apple was “giving up on hardware sales” to instead pivot to selling content and services, as if the company can only do one thing at once. That idiot hot take invented a year ago in response to Apple’s presentation of its new Services offerings including Arcade, TV+, and Apple Card has clearly continued to be dead wrong, as iPhone 11 outpaced the growth of premium Android sales and as consumers snapped up Macs, iPad, Apple Watch, and AirPods in record volumes.

The economic pressures on families and individuals who are unable to go to work this month—and who may face a domino effect of other critical issues throughout this year as the pandemic continues to cause massive interruptions and tragic loss for people—is a serious problem for every industry. So why portray things as particularly troublesome for a company that has so much cash that it can float through years of crisis without much problem at all?

That happened in 2008, when analysts and investors imagined that “global macroeconomic issues” would hit Apple’s luxury goods the hardest, perhaps blunting sales of the then-new iPhone, which was priced several times higher than a variety of competing smartphones from Microsoft, Motorola, Nokia, and many others. Those predictions similarly failed to materialize. Despite Apple’s stock price crashing in half twice that year, the company emerged stronger than ever and its sales of iPhones radically shifted the balance of power in the tech industry.

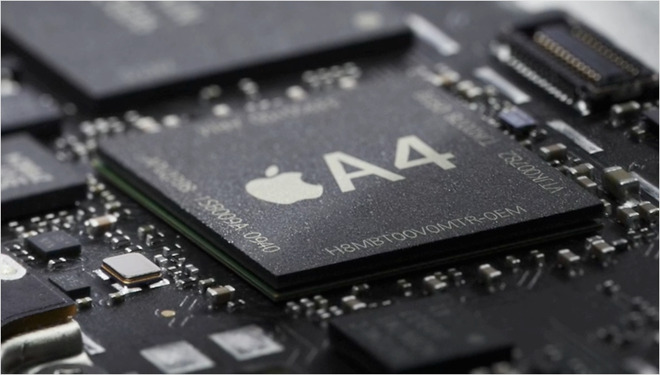

During 2008, rather than retracting into a cave and helplessly watching as its cash reserves evaporated, Apple aggressively began investing in custom silicon under a new project that resulted in A4. Long before anyone appreciated how big iPhone could become, Apple was planning for a future where iPhone 4 would deliver the luxurious feel of a Hasselblad camera, and where casual mobile computing would shift from cheap netbooks running Linux or a scaled-down edition of Windows to a new ultra-slim tablet form factor branded as iPad.

Apple saw that future years in advance when many pundits still couldn’t quite grasp it years after watching it occur right in front of them. And as they moved on to worry about their next concerns about Apple, the company planned out future years of success that developed into global leadership in tablets, watches, and wireless earpods.

When the sky fell in 2008, Apple invested in the future

Apple’s cash allowed it to deftly line up partnerships and significant acquisitions like P.A. Semi at a time when analysts were screaming that the ceiling was collapsing and that investors should flee to the mountains and convert their wealth into gold. They were ultimately wrong; Apple’s stock climbed out the fearful 2008 to rocket upward as the company cranked out regular new advances, regardless of whether every person in America or the rest of the world could afford to pay for an annual upgrade to every Apple device they owned.

Things have changed significantly since 2008. Apple’s stock is now valued around twenty times higher than its nadir that year—even after the COVID-19 drop—and the company has shifted from an upstart phone maker to being the only company selling premium-priced tech in massive volumes and at margins that are capable of shielding the company from even the worst of disasters. That included even the unanticipated combination of the earthquake, tsunami, nuclear plant failures, and other catastrophes that hammered Japan all at once, just as Apple was introducing iPad 2 with a variety of components sourced right at the epicenter of that composite disaster.

A better question is: why is Mickle not even mentioning Apple’s peers: companies that are just as dependent on China if not more so, which will face even greater problems in producing their higher volumes of devices at much lower average selling prices, and for whom their audience of buyers is made up of people who are on the lower tiers of the economic ladder—people who will be hit harder and be more adversely affected in their ability to buy flashy new phones or other products this year.

What sort of market potential is greeting those fancy new 5G Android flagships from Samsung and Huawei, or those $1,500 to $2,600 folding display prototypes that the tech media has been both excited to review and super curious about why Apple wasn’t also floating out such gimmicky frivolity rather than building solid products that consistently sell by the tens of millions.

Surely that’s a bigger story than whether some marginal fraction Apple’s minority of smartphone buyers will be able to afford to buy an iPhone 12. Apple’s customers range from well-heeled individuals who can buy anything Apple makes to the rank and file that somehow has survived the last five years of increasing economic disparity, and despite being hobbled by crippling student debt, healthcare costs, and low-paying wages with slim benefits, still somehow manages to stay up to date with Apple’s best iPhones and keeps flexing their AirPods and automatically pays for Apple Music and iCloud without stressing too much about it.

After being so wrong for so long, finance bloggers really need to slash production of their own fabrications, because their stock is tanking.