India has emerged as one of the fastest growing smartphone markets in the last decade, reporting growth each quarter even as handset shipments slowed or declined elsewhere globally. But the world’s second largest smartphone is beginning to feel the coronavirus heat, too.

The Indian smartphone market grew by a modest 4% year-over-year in the quarter that ended on March 31, research firm Counterpoint said Friday evening. The shipment grew annually in January and February, when several firms launched their smartphones and unveiled aggressive promotional plans.

But in March, the shipment saw a 19% year-over-year dip, the firm said. Counterpoint estimated that the smartphone shipments in India will decline by 10% this year, compared to a 8.9% growth in 2019 and 10% growth in 2018.

The research firm also cautioned that India’s lockdown, ordered last month, has severely slowed down the local smartphone industry and it may take seven to eight months to get back on track. Currently, only select items such as grocery products are permitted to be sold in India.

Prachir Singh, Senior Research Analyst at Counterpoint Research, said the Covid-19 impact on India was relatively mild until mid-March. “However, economic activities declined as people save money in expectation of an extended period of uncertainty and an almost complete lockdown. Almost all smartphone manufacturing has been suspended. Further, with the social distancing norms, factories will be running at lower capacities even after the lockdown is lifted,” he said.

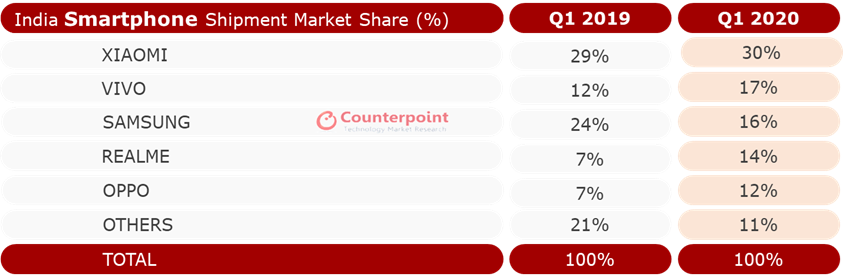

Overall, 31 million smartphone units shipped in India in Q1 2020. Chinese smartphone maker Xiaomi, which has held the tentpole position in what has become its biggest market globally for more than two years, widened its lead to command 30% of the market.

Vivo’s share grew to 17%, up from 12% during the same period last year. Samsung, which once led the Indian market, now sits at the third spot with 16% market share, down from 24% in Q1 2019. Apple maintained its recent momentum and grew by a strong 78% year-over-year in Q1 this year. It now commands 55% of the premium smartphone segment (handsets priced at $600 or above.).

More than 100 smartphone plants in India assemble or produce about 700,000 to 800,000 handsets a day, some of which are exported outside of the country. But the lockdown has halted the production and could cost the industry more than $3 billion to $4 billion in direct loss this year.

“We often draw parallels between India and China. But in China, their factories have adopted automation at various levels, something that is not the case in India,” said Tarun Pathak, a senior analyst at Counterpoint, earlier this week.

China, where smartphone sales declined by 38% annually in February this year, has already started to see recovery. Xiaomi said last month that its phone factories were already operating at more than 80% of their capacity. Globally, smartphone shipment declined by 14% in February, according to Counterpoint.